Published on 2025-06-29T20:25:44Z

What is Payment Gateway Integration? Examples for Payment Gateway Integration

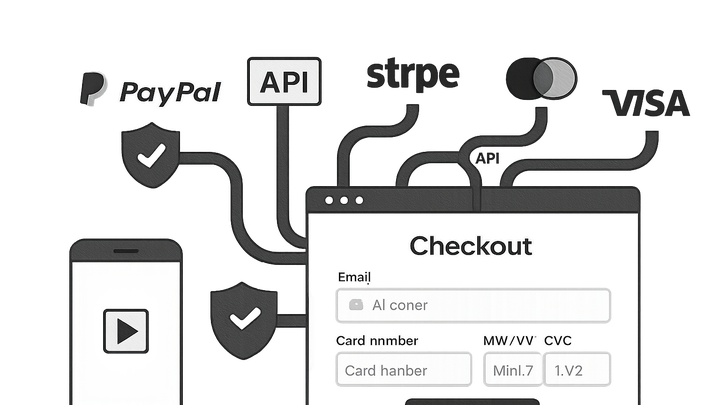

Payment Gateway Integration is the process of connecting your website’s checkout with a payment processor to accept online payments securely. This involves setting up APIs or hosted forms, ensuring compliance with security standards like PCI DSS, and optimizing the flow to reduce friction for users. Effective integration impacts conversion rates, user trust, and can even influence SEO through page performance and secure protocols (HTTPS). In a CRO/UX/SEO context, evaluating your payment gateway integration means looking at load times, error handling, accessibility, and clarity of fees and steps. Tools like PreVue.me can provide targeted critiques to help you refine every aspect of your payment flow.

Payment gateway integration

Connecting sites to payment processors for secure transactions improves UX, SEO, and conversion rates.

Why Payment Gateway Integration Matters

A smooth and secure payment gateway integration is critical for converting visitors into customers. It builds trust through data encryption, reduces cart abandonment by streamlining the checkout flow, and ensures compliance with security standards. Additionally, payment pages that load quickly and securely (HTTPS) can positively affect SEO rankings. In the context of CRO and UX, every step in the payment flow should be intuitive and fast to keep users engaged.

-

Secure transaction processing

Payment gateways encrypt sensitive data and route transactions through secure channels, minimizing fraud and data breaches. This security assurance is vital for user trust and legal compliance.

- Pci dss compliance:

Adhering to Payment Card Industry Data Security Standards ensures that cardholder data is processed and stored securely.

- Ssl/tls encryption:

Using HTTPS protects data in transit, signaling trust to both users and search engines.

- Pci dss compliance:

-

Impact on conversion rates

A seamless, fast payment experience reduces drop-offs. Complex flows or slow load times directly correlate with higher abandonment rates.

-

Seo and ux considerations

Payment pages optimized for speed and security contribute to better SEO performance. Clear labels, progress indicators, and minimal form fields enhance user experience.

Key Components of Payment Gateway Integration

Integrating a payment gateway involves multiple components working together: the gateway API/SDK, a merchant account, secure data handling, and support for various payment methods. Each piece must be correctly configured to ensure reliability and compliance.

-

Api & sdk integration

Most payment gateways provide REST APIs and SDKs (JavaScript, PHP, mobile SDKs) to embed payment forms or process transactions server-side. Example of a simple HTML form integration:

<form action="https://gateway.example.com/pay" method="POST"> <input type="hidden" name="amount" value="1000"/> <button type="submit">Pay Now</button> </form> -

Merchant account & payment processor

A merchant account holds funds from transactions before settling to your bank, while the payment processor routes transactions between the gateway and card networks.

-

Security & compliance (pci dss)

Implement tokenization to avoid handling raw card data, use secure vaults, and undergo regular security audits to maintain PCI compliance.

Best Practices for Integration

Following industry best practices ensures your integration is user-friendly, secure, and optimized for conversions. Regular testing and monitoring are key to identifying and fixing issues promptly.

-

Optimize for mobile

Design responsive payment forms with large touch targets and avoid popup windows that may be blocked on mobile browsers.

-

Streamline checkout flow

Minimize form fields, enable address autofill, and consider a one-page checkout to reduce friction.

-

Accessibility compliance

Use ARIA labels, proper focus management, and ensure color contrast and keyboard navigation work seamlessly.

-

Error handling & user feedback

Provide clear, inline error messages and real-time validation to help users correct mistakes without frustration.

Common Pitfalls to Avoid

Identifying and avoiding common errors can save time and prevent lost sales. Regularly review your payment flow to ensure nothing hinders the user from completing a purchase.

-

Forcing account creation

Requiring users to create an account before purchasing can increase abandonment; offer a guest checkout option.

-

Complex payment forms

Long, complicated forms intimidate users. Ask only for essential information and split forms into logical steps if needed.

-

Lack of fee transparency

Hidden or unexpected fees just before purchase can erode trust and lead to cart abandonment.

Payment Gateway Integration with PreVue.me for CRO/UX/SEO Critiques

PreVue.me offers targeted audits of your payment flow to identify friction, accessibility issues, and SEO concerns. It delivers actionable insights to optimize every aspect of your checkout.

-

Actionable cro critiques

PreVue.me pinpoints friction points—like hidden form errors or confusing button labels—and suggests data-backed improvements.

-

Ux & accessibility feedback

The tool highlights accessibility violations (e.g., missing labels, inadequate contrast) and UX hurdles that impede smooth transactions.

-

Seo impact analysis

PreVue.me reviews load times, metadata, and structured data on payment pages to ensure they meet SEO best practices.